Keeping Users Engaged by Designing Money Flows Within Chat

Problem Statement

In everyday conversations, users frequently coordinate shared expenses, meals, rides, gifts in chat. But when it comes time to settle up, they’re forced to leave the app to complete the transaction elsewhere. This context-switch breaks the flow, creates friction, and leads to user drop-off at a critical engagement point.

We saw an opportunity to close this gap by embedding lightweight, essential money tools, send, request, and split directly into the messaging experience. The goal was simple: help users take action while the intent is still fresh, without needing to leave the conversation.

Lean UX Approach

With a tight timeline for initial rollout, we adopted a lean, pragmatic UX process focused on identifying usability friction early and validating our core assumptions quickly.

Key research methods:

• Heuristic analysis of existing fintech and peer payment tools to understand standard UX patterns and friction points.

• Targeted usability testing of key flows, including KYC, bank linking, and peer transactions.

• Internal dogfooding to simulate real-life use cases like bill splitting and casual send/request interactions.

This approach gave us the directional confidence to launch a usable foundation, while leaving space for deeper iteration based on real-world usage and feedback post-launch.

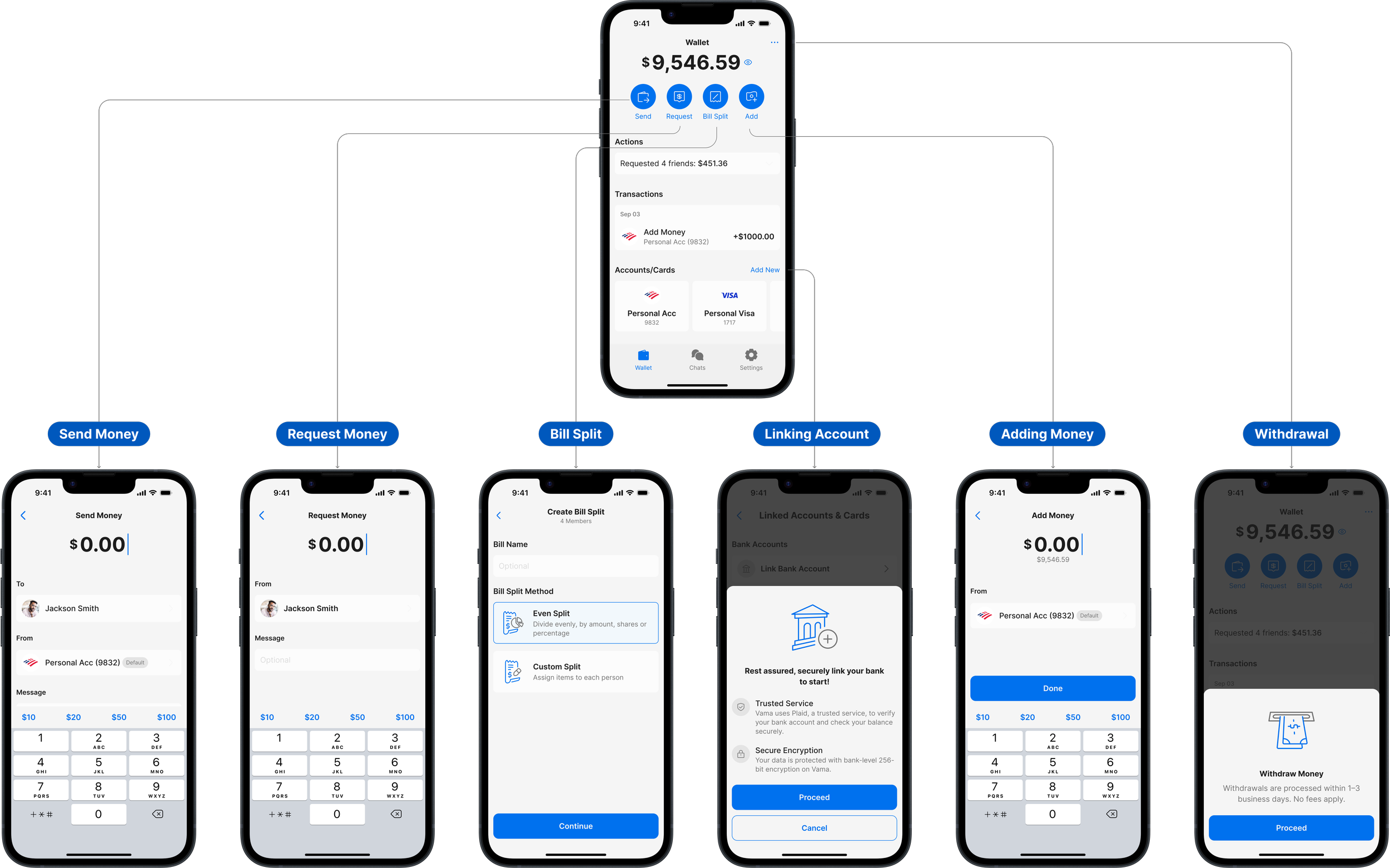

Solution: A Lightweight Wallet for Conversational Money Flows

To reduce drop-off and increase in-app engagement, we designed and shipped an MVP wallet experience that could serve the most common peer-to-peer use cases while feeling seamless and approachable inside a messaging-first platform.

Core MVP Features:

• Main Wallet Interface

Clean, accessible view of balance and transaction history, focused on clarity and user confidence.

KYC Flow

Compliant, streamlined onboarding using progressive disclosure to guide users through identity verification with minimal friction.

Bank Linking via Plaid

Fast, secure account connection with clear trust signals and minimal cognitive load.

Add Money

Enabled users to preload funds into the wallet for quick peer transactions.

Send & Request Money

In-chat interactions that feel conversational, not transactional with contextual confirmations to maintain flow and trust.

Bill Split Consideration

Designed early support for group cost sharing, including auto-split logic and structured requests within chat threads.

Withdraw to Bank

Easy path to move money out of the wallet, a key trust-building factor in financial experiences.

This MVP prioritized the highest-friction, most common money moments users encounter inside chat by giving them the power to act without breaking context, and laying the groundwork for a richer, more connected financial layer in the future.

What We’re Learning and How We’ll Measure Success

While we’re still in pre-launch, early internal testing has surfaced key behavioral insights and we’ve established clear success metrics to track post-launch performance.

Early Learnings

• Entry points drive intent

While the wallet lives in a separate tab, users expect to initiate money actions from within the chat itself. Embedding send/request inside chat bubbles reinforces immediacy but visibility and timing are critical.

• Trust is built through control

KYC and Plaid flows require strong signals of safety and clarity. Features like progress indicators, staged steps, and simplified copy greatly increased user confidence in our tests.

• Surface switching must feel purposeful

Users are open to moving between chat and wallet as long as the transition is short, intuitive, and clearly tied to their previous action. Seamless handoff between contexts improves adoption.

Success Metrics (Post-Launch)

Our goal is to reduce transactional friction and improve engagement during key money moments. We’ll be measuring:

• Wallet activation rate

% of users completing KYC and linking accounts after discovering wallet features.

• Chat-to-wallet action rate

Volume of send/request/split flows initiated from chat vs. via the wallet tab.

• Drop-off rate after money talk

Reduction in users exiting the app after discussing expenses or payments.

• Peer transaction frequency

Growth in weekly active peer-to-peer money transfers.

• Group bill split usage

Adoption and frequency of cost-splitting tools within group chats.

These metrics alongside qualitative usage patterns will guide our next iterations as we work toward a unified conversational-financial experience that’s intuitive, trustworthy, and fully embedded in the way users already communicate.