Reframing Low-Risk Investing for Cash-Oriented Users

Problem Statement

While StashAway offered a range of risk-based portfolios, it lacked a dedicated low-risk investment product to serve users seeking stable returns with flexible access users who often defaulted to savings-based products. These users weren’t disengaged; they simply didn’t see a suitable option for their short-term, low-volatility needs.

We saw a strategic opportunity to:

• Retain and grow our existing user base by filling this product gap

• Encourage movement from passive savings to active investing

• Reframe “income investing” as something accessible and flexible, not something locked in for years

To meet this need, we partnered with J.P. Morgan to launch a new low-risk income investment product, one that aligned with cash-oriented behaviors while still delivering portfolio diversification and return potential.

Research & Strategic Insights

This product was driven by both market need and user behavior signals:

Business Context:

• Users were holding excessive cash in savings plans due to a lack of low-risk alternatives

• Competitors had started offering “cash plus” or flexible income options

• We needed a solution to bridge the behavioral gap between saving and investing, while keeping assets within the platform

User Behavior Insights:

• Users associated “income investing” with long-term lock-ins or retirement products

• Liquidity and control over cash were major psychological drivers even when actual withdrawal behavior was low

• Simplicity, trust cues, and the ability to preview returns were key to driving adoption

These insights informed how we positioned and designed the product: not as a traditional portfolio, but as a goal-based, income-generating solution that aligned with how users already think about money.

Solution: Designing a Flexible Income Investment Experience

To meet user needs, financial goals, and regulatory requirements, we designed an end-to-end experience that combined clarity, control, and customization.

Core Features:

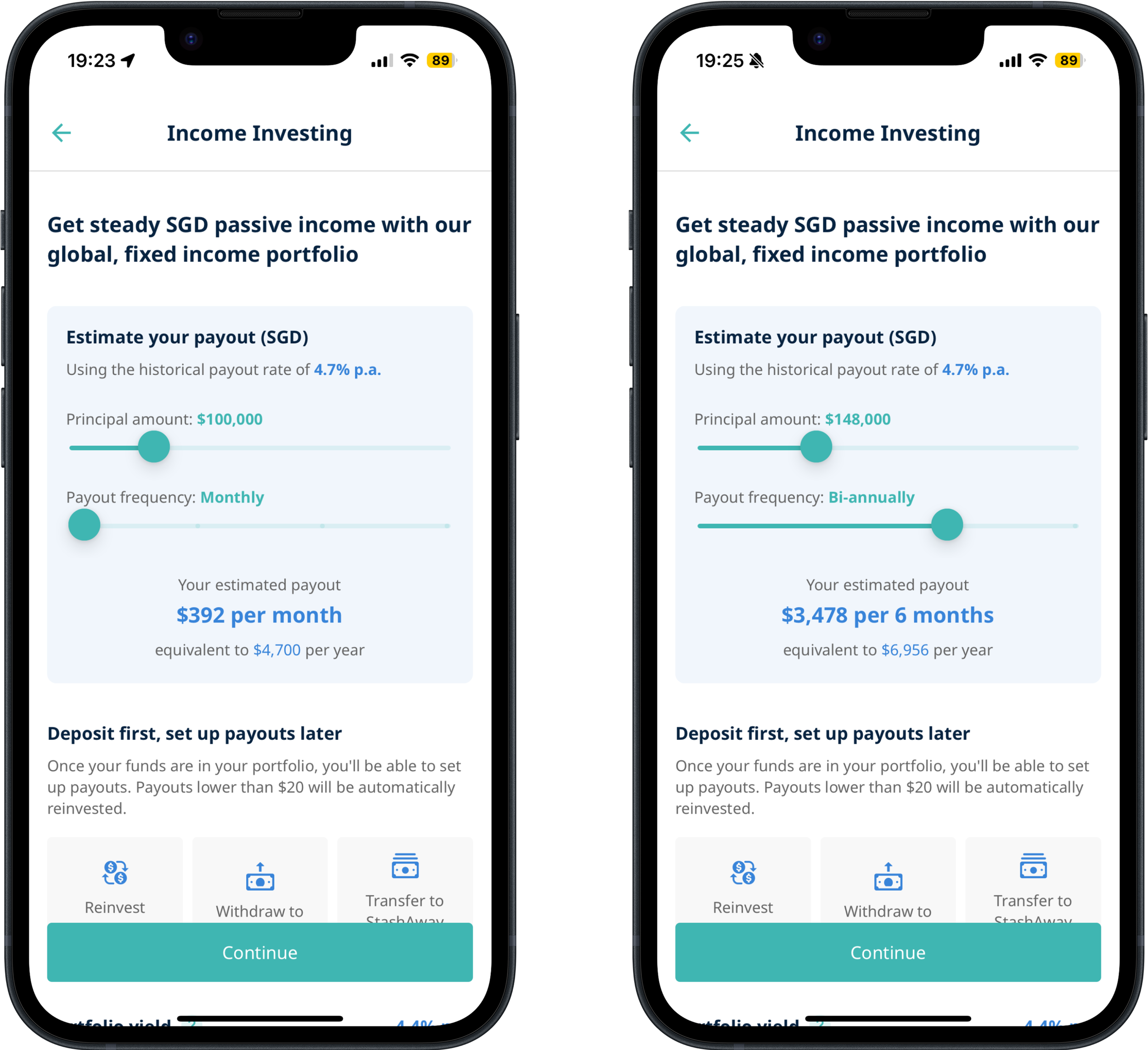

Payout Estimation & Customization

An interactive flow allowing users to estimate potential returns and select their preferred payout frequency: monthly, quarterly, or custom.

Visual feedback helped users quickly understand trade-offs and adjust based on their needs.

KYC Integration

Embedded compliance flows (Know Your Customer) directly into the setup experience, ensuring seamless onboarding while maintaining trust.

Payout Selection Flow

Designed a simple yet flexible experience to let users customize withdrawal amount and timing helping reframe income investing as responsive, not rigid.

Mobile-Optimized Simplicity

Given our mobile-first user base, all features were designed for ease of interaction, including tappable sliders, dropdowns, and confirmation steps with plain-language summaries.

Early Learnings:

• Control drives conversion: Users felt more confident when they could see and set payout expectations even if they didn’t change the defaults.

• Liquidity is psychological: Simply offering flexible withdrawal options eased hesitation, few users withdrew funds during testing, but knowing they could was key to onboarding.

Success Metrics (Post-Launch):

• Activation from cash-heavy segments: % of users who shift from savings products to this investment

• Payout customization adoption: How often users adjust income frequency or amount

• Perceived product clarity and trust (measured via post-setup survey NPS and confidence scores)

• Retention and re-engagement: Continued usage over 30/60/90 days, particularly among users new to investing

• Withdrawal behavior patterns: Monitoring usage of flexible access and its correlation with retention

Conclusion

By addressing both a strategic business gap and a clear user behavior pattern, we successfully introduced a low-risk, income-focused investment product that repositions investing as a flexible, cash-compatible experience.

This case highlights how user research, product positioning, and interaction design work together to transform perception, reduce friction, and create meaningful financial behaviors without overwhelming users with jargon or unnecessary complexity.